2023 Budget maintains service levels while balancing inflationary pressures and planning for the future

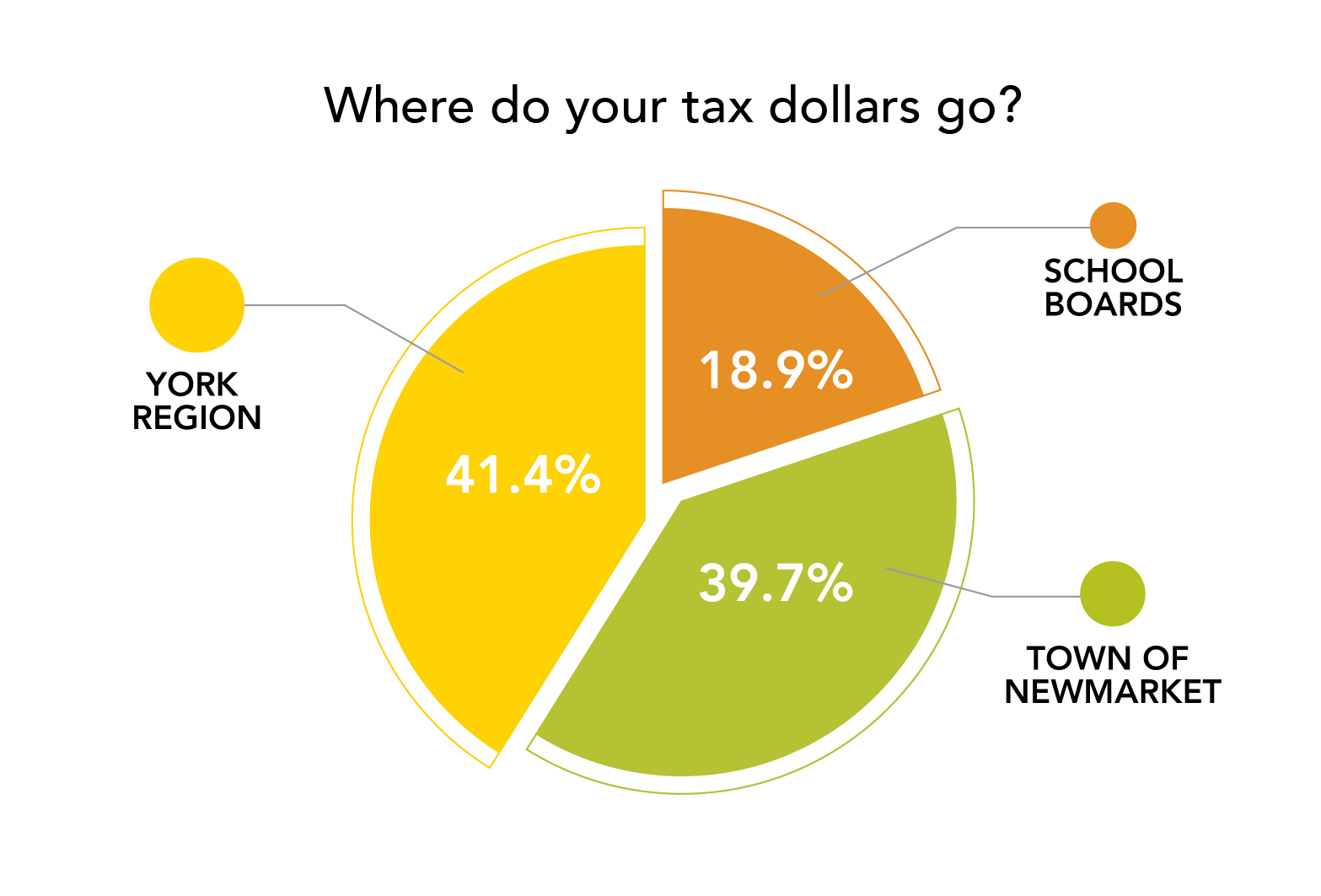

At the April 3 Council Meeting, Newmarket Council approved the 2023 Budget after many meetings of working to find a balance between maintaining current service levels and limiting the impact on current and future tax payers. After months of reviewing options to decrease the potential tax impact, Council approved a fiscally responsible . This equates to a $125 increase ($10.41 per month) for the average resident (based on MPAC’s Current Value Assessment at $706,000).

Throughout the 2023 budget process, Council and staff worked together to find savings wherever possible. As a result of Council direction, the Town of Newmarket property tax increase was reduced significantly from the originally proposed 13 per cent to the approved 5.6.

The 2023 Budget will maintain all levels of service to residents, continue to invest in our Asset Replacement Fund, while staying aligned with Newmarket’s Fiscal Strategy.

The total approved 2023 Operating Budget is $147.3 million, and the Capital Budget is $63.1 million with a combined total of $210.4 million

2023 Budget Information

- 5.5 per cent tax increase (Town Portion)

- Equals to $125 increase or $10.41 per month for the average resident (based on MPAC’s Current Value Assessment at $706,000).

- $50 per year increase on the water and wastewater bill ($4.16 per month) for the average resident

- $5 per year increase for the stormwater charge (0.42 per month) for the average resident

Operating Budget

The Operating Budget ($147.3 million) will pay for the day-to-day Newmarket resident services including emergency and fire services from Central York Fire Services and the operation of the Newmarket Public Library. Property taxes pay for 50 per cent of the operating budget with the remaining amount funded through other revenue sources (provincial grants and subsidies, user fees, sponsorships etc.). See below for what each Newmarket service would cost on a monthly basis for the average home assessed at $706,000 in Newmarket:

Note: The average assessed home by MPAC is valued at $706,000 in Newmarket. Property Assessments are conducted by MPAC (Municipal Property Assessment Corporation). All properties are valued in their current state and condition as of January 1, 2016 and not the current market value.

Capital Budget

The Capital Budget funds major construction projects and repairs and upgrades to the Town’s assets and infrastructure. Newmarket continues to deliver capital programs with funding sources from development charges, grants from other levels of government and partnerships. Highlights of the Capital Budget include:

- Continued work on the Mulock Property

- Continued work on the Mulock Multi-Use Path which will run from Bathurst Street to Harry Walker Parkway (approx. 6km) along Mulock Drive

- Replacement and upgrades at various Newmarket facilities

- Replacement and upgrade of the Town’s fleet equipment and vehicles

- Road resurfacing projects to ensure Newmarket roads are safe

- Continued investment into the maintenance of stormwater ponds that will reduce localized flooding and protect the environment from stormwater runoff.

Budget Reports and Presentations

Attend a Budget Meeting

Budget Meeting Schedule

Get involved and attend a budget meeting virtually. All Council and Committee of the Whole meetings will be streamed live online at newmarket.ca/meetings at the start time indicated below. All meetings will also be archived to be viewed at a later date.

You can also join the discussion by making a live video deputation, calling into the meeting to provide your comments, or emailing your comments to

[email protected] before the deadline posted on the meeting agenda.

Learn more about how you can get involved.

Meeting / Activity

|

Date

|

Meeting |

Capital and Rate Supported Operating Budgets

| February 13, 2023

| Special Committee of the Whole

|

Tax-supported Operating Budget

| March 20, 2023

| Special Committee of the Whole

|

Presentation of the Draft Budgets and remaining Fees & Charges

| March 27, 2023

| Committee of the Whole

|

Approval of the Budgets and Remaining Fees and Charges

| April 3, 2023

| Special Committee of the Whole

|

Reserve and Reserve Fund Review Council Workshop

| Q2/Q3

| Council Workshop

|

Asset Management Workshop

| Q2/Q3

| Council Workshop

|

Additional Information about the Budget